Our Services

Empowering Growth Through Smart Investment & Financial Strategies

At Gulf Bridge Capitals, we deliver cutting-edge financial and investment services tailored to meet the evolving needs of businesses, governments, and private investors across Asia Africa, Europe, North America, South America, Australia (Oceania). With decades of experience in private equity, capital management, infrastructure investment, renewable energy, and strategic finance, our firm stands at the forefront of transformative growth and sustainable development.

National & Private Capital Finance Solutions

Flexible Financing for Every Business Stage

At Gulf Bridge Capitals, we understand that every business whether a startup, SME, or large-scale enterprise experiences cycles that demand dynamic financial solutions. Through our National Finance Division, we provide adaptive capital strategies designed to address key milestones in a business’s lifecycle.

Our financing model is built with entrepreneurial understanding. As business developers ourselves, we appreciate the capital challenges businesses face from cash flow gaps to scaling operations. We work hand-in-hand with owners and stakeholders to structure bespoke financial instruments, including:

Working Capital Solutions

Growth & Expansion Financing

Bridge Loans and Mezzanine Financing

Equity and Debt Restructuring

By partnering with us, clients gain access to a deep network of regional and global investors. Whether it’s early-stage seed funding or late-stage capital for acquisitions, our focus is on aligning investor interests with long-term business performance.

Bank Partnership & Strategic Financing

Beyond Traditional Banking – Innovative Partnerships That Work

Traditional banking often lacks the flexibility growing businesses need. That’s why Gulf Bridge Capitals has established strong strategic banking partnerships across Asia Africa, Europe, North America, South America, Australia (Oceania). Since our inception in 1990, our mission has been to go beyond basic banking to offer true financial partnerships.

Through these alliances, we provide our clients access to:

Credit Facilities with Favorable Terms

Project-Based Financing

Syndicated Loans

Trade Finance and Export Credit Lines

Sharia-Compliant Finance Options

In partnership with major financial institutions and regional development banks, Gulf Bridge Capitals bridges the gap between mainstream banking and bespoke investment needs. We help businesses secure funding for key projects, infrastructure development, or regional expansions without being restricted by traditional financial systems.

Our team also offers investment banking advisory, helping companies prepare for IPOs, mergers & acquisitions, or asset sales.

Jet Fuel Trade & Energy Investment

Energy Trade Expertise That Fuels Growth

With its strategic focus on energy investments, Gulf Bridge Capitals actively operates in the jet fuel trade, one of the most lucrative commodities in the Asia Africa, Europe, North America, South America, Australia (Oceania). We help meet the high global demand for aviation fuel by facilitating efficient, compliant, and secure fuel trading operations.

Our services in the jet fuel sector include:

Procurement & Supply Chain Optimization

International Trade & Contract Negotiations

Storage & Logistics Coordination

Risk Mitigation & Hedging Strategies

Backed by long-standing partnerships in Asia Africa, Europe, North America, South America, Australia (Oceania), and a vast supplier and buyer network, we ensure seamless transactions. We also assist aviation clients in establishing long-term supply contracts with best-in-class refineries and producers.

Jet fuel is not just a commodity it’s a strategic asset. And we make sure our clients are positioned at the heart of this opportunity.

Renewable Energy & Solar Power Projects

Investing in a Sustainable Energy Future

As the global focus shifts toward clean energy, Gulf Bridge Capitals is leading the charge in investing and facilitating solar power and battery energy storage solutions. We believe renewable energy is not only a moral imperative but also a compelling investment opportunity.

Our renewable energy division offers:

Project Development & Structuring

Solar Power Infrastructure Investment

Battery Energy Storage Systems (BESS)

Power Purchase Agreements (PPA) Structuring

Green Bonds & Climate Financing

We support residential, commercial, industrial, and governmental energy transition projects. Our team evaluates feasibility, regulatory compliance, and ROI to create investor-ready opportunities in Asia Africa, Europe, North America, South America, Australia (Oceania).

Co-Investment & Private Market Opportunities

Empowering Private Capital with Institutional Insight

Gulf Bridge Capitals provides co-investment opportunities that allow private investors to participate in large-scale infrastructure and development projects across emerging markets. Our investment model ensures transparency, aligned interests, and high-return potential.

Key investment sectors include:

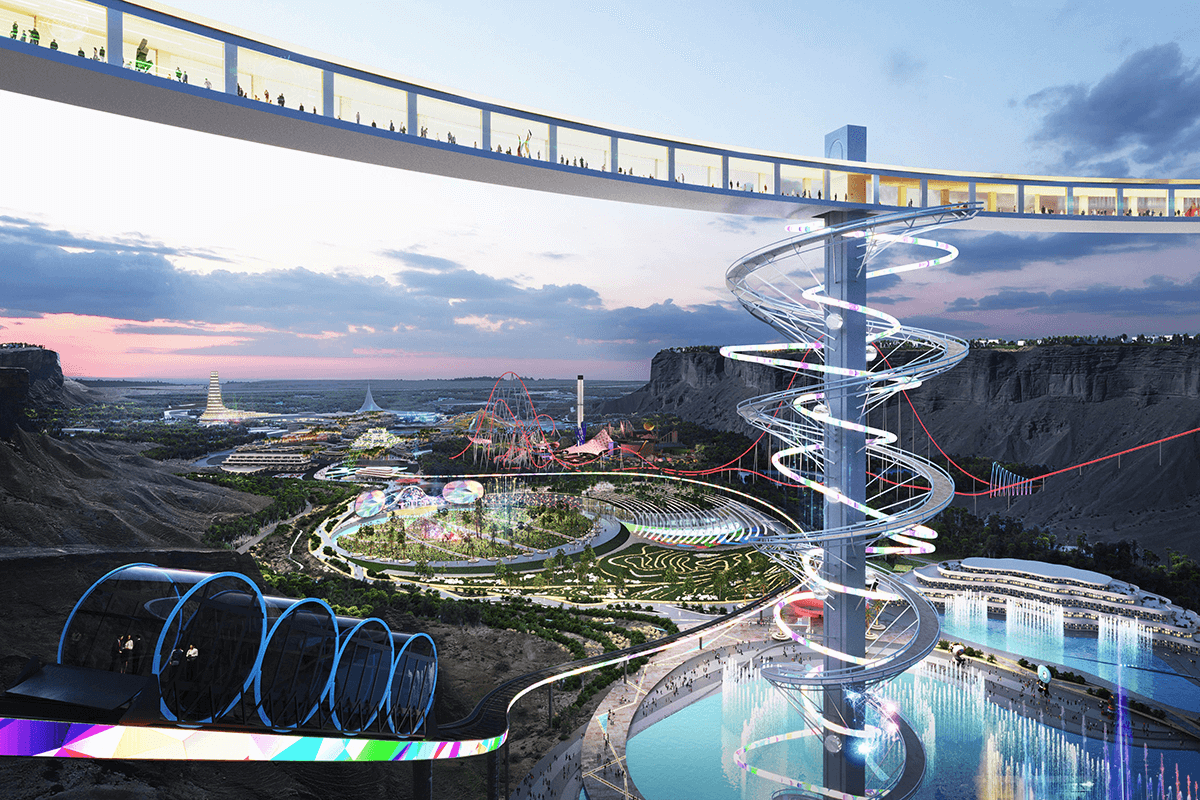

Infrastructure & Transportation

Healthcare & Medical Facilities

Industrial Manufacturing

Technology & Digital Infrastructure

Hospitality & Tourism Projects

Our experts carefully curate and manage each co-investment project, ensuring due diligence, risk assessment, and ongoing performance tracking. Whether it’s a logistics park in Turkey or a high-growth health-tech startup in Qatar, our investors gain exposure to highly diversified and profitable asset classes.

Investment Advisory & Asset Management

Maximizing Returns through Strategic Insight

Beyond direct investments, Gulf Bridge Capitals offers tailored asset management and advisory services. Our expert team works closely with institutional and high-net-worth investors to structure, monitor, and optimize diversified portfolios.

Our advisory capabilities include:

Portfolio Structuring & Diversification

Risk Management & Performance Monitoring

Succession & Estate Planning

Sharia-Compliant Investment Options

Cross-Border Tax Optimization

We combine local insight with global best practices to ensure your capital is not only protected but strategically grown. Gulf Bridge Capitals serves as a trusted partner in your financial journey—backed by market intelligence, regulatory awareness, and decades of experience.

Emerging Market Opportunities

Unlocking the Growth Potential of Untapped Economies

We specialize in investment opportunities across emerging markets where capital injections lead to transformative development. From frontier economies in Africa to transitioning markets in Asia Africa, Europe, North America, South America, Australia (Oceania), Gulf Bridge Capitals navigates the complex terrain with precision.

We offer:

Market Entry Strategies

Joint Ventures & Strategic Alliances

Public-Private Partnership Structuring

Government Relations & Legal Advisory

Investors and partners benefit from our local networks, risk mitigation frameworks, and on-ground execution capabilities. Gulf Bridge Capitals enables capital to reach where it’s most needed and most rewarded.

Why Choose Gulf Bridge Capitals?

Your Gateway to Secure, High-Yield Investments

35+ Years of Industry Leadership

Deep Market Understanding Across Asia Africa, Europe, North America, South America, Australia (Oceania)

Unrivaled Network of Global Investors and Institutional Partners

Transparent, Compliant, and Ethical Investment Practices

Customizable Investment Vehicles – Built for You

Whether you’re an institutional investor, private equity firm, or visionary entrepreneur Gulf Bridge Capitals is your partner in navigating financial complexity and achieving sustainable success.